When I first read the resignation letter of Goldman Sachs executive Greg Smith three years ago, I knew something wasn't right in the way financial institutions operate. A myriad thoughts ran through my mind.

Image may be NSFW.

Clik here to view.

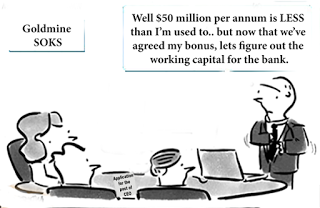

When we trust the people who advise us and implicitly follow the financial institutions that handle our hard-earned money, we believe that we are buying professional advice at a fee that is normal.

The reality across financial institutions is far from it. The very fundamental of NIM (net interest margin or commission on transactions) that forms the bedrock of banking, investment or otherwise, stands compromised when a client is referred to as a "muppet" or when transactions are done to make a "hit and run".

I am going to tell you three short stories here.

Story 1: Winners and losers

Yes "hit and run". I have been coming across this term a lot lately. It's uttered by entrepreneurs who are trying to attract funds to make "unicorns" out of their amazing, sustainable, scalable ideas. I've also heard this term from the very people funding these new ventures, each one hoping to find a "muppet" before passing the parcel stops and the last muppet obviously files for Chapter 11.

At a time when 7 trillion of global market cap was eroded in just one week between 24-28th August 2015, the net worth of Goldman Sachs CEO Lloyd Blankfein shot through the roof - he's now a billionaire. Obviously, he found the right "muppets".

The incapability of most people to connect the dots and take informed decisions leads to severe imbalances that keep aggregating to unmanageable proportions which eventually become endemic on a global scale.

In the early part of 2008, Arjun Murti of Goldman Sachs predicted crude oil may rise up to $200. He must have found thousands of muppets on whom to dump oil futures and earn hefty bonuses in trading commissions. That is, until February of 2009, when crude only accelerated right back towards the earth to below $40.

By the December of 2014, when the crude had already fallen to $65 from $110 levels Goldman went on to predict a $40 level in the coming months. I am sure they amassed billions in commissions on the basis of their specious advice to gullible investors.

At the time of writing, crude was around $37 and Goldman now says that oil could soon be $20.

"[N]ext time someone tries to sell you a capital-protected market-linked investment/insurance plan... get the hell away, for such a thing doesn't exist now and nor will it in the future."

What amazes me is the blatant manner in which "super" financial institutions such as Goldman Sachs and others across the globe misguide investors and get away with it. No real regulation has been formulated to make these goliaths accountable. No one seems to question them and their perpetual search for muppets continues unabated.

Story 2: A game that everyone played

In a quest to make supernormal profits, many top financial institutions colluded to fix the loan markets at the cost of billions of retail borrowers, rigging the London Interbank Offered Rate (LIBOR) in the process. Former UBS trader Tom Hayes might be the face of the scandal and now a state "guest" for 14 years but can you even begin to imagine that LIBOR, which is allegedly the most transparent measure of global financial health, was fixed fraudulently for decades? As a result loan seekers were paying larger than required interest rates and in every way feeding the bonuses (linked to profitability) of bankers across the globe.

When fraud is at a mass market level, it's in every ones interest to hide it -- for it's impossible to convict 80% of bankers.

Story 3: Collateral damage

It was a sad day on Wall Street when Sarvashreshth Gupta, a 22-year-old Goldman Sachs analyst jumped to his death after complaining of 100-hour work weeks, intense pressure, unrealistic deadlines and ridicule by his boss. When he left India as a student of the University of Pennsylvania, the family probably celebrated the start of a wonderful new future for him (for dreams come true when you travel to new countries for education and jobs and money), not realising that he would end up as a mere pawn to satisfy someone else's greed.

Moral of the three stories

At an extrinsic level these instances might be viewed as isolated cases of individual unscrupulousness/failure/misplaced ambitions. But dig deeper and these stories are a reflection of an irreparable rot that has infested corporate culture. It's a world where irrational demands and insatiable expectations of abnormally high profits make people do things that are outside the bounds of propriety.

Culture in families, in organisations, in countries and on the planet is a function of varying degrees of greed and righteousness. The global culture now sits on a bedrock of an ultra-capitalised greedy planet that is only working towards higher and higher profit and bonuses.

Unless the captains of the industry such as Blankfein and hundreds like him don't take it upon themselves to stem their greed and change the corporate culture, the talent and lives of people like Greg Smith, Tom Hayes and Sarvashreshth Gupta will continue to get wasted. What we need are results, profitability and achievements of Annual Operating Plans that are a function of an organisational culture rooted in happiness, care, trust, patience, compassion -- and not simply a mindless pursuit of month-on-month profit.

We are born to be "naturally" truthful, happy and stress-free and cohabitate peacefully on this planet with each other. Greed and fraud and deceit take a lot of effort. The choice is entirely ours. The seeds we sow in our organisations today are what will eventually form the "corporate culture".

And next time someone tries to sell you a capital-protected market-linked investment/insurance plan (which only God can guarantee) get the hell away, for such a thing doesn't exist now and nor will it in the future.

Image may be NSFW.

Clik here to view.

When we trust the people who advise us and implicitly follow the financial institutions that handle our hard-earned money, we believe that we are buying professional advice at a fee that is normal.

The reality across financial institutions is far from it. The very fundamental of NIM (net interest margin or commission on transactions) that forms the bedrock of banking, investment or otherwise, stands compromised when a client is referred to as a "muppet" or when transactions are done to make a "hit and run".

I am going to tell you three short stories here.

Story 1: Winners and losers

Yes "hit and run". I have been coming across this term a lot lately. It's uttered by entrepreneurs who are trying to attract funds to make "unicorns" out of their amazing, sustainable, scalable ideas. I've also heard this term from the very people funding these new ventures, each one hoping to find a "muppet" before passing the parcel stops and the last muppet obviously files for Chapter 11.

At a time when 7 trillion of global market cap was eroded in just one week between 24-28th August 2015, the net worth of Goldman Sachs CEO Lloyd Blankfein shot through the roof - he's now a billionaire. Obviously, he found the right "muppets".

The incapability of most people to connect the dots and take informed decisions leads to severe imbalances that keep aggregating to unmanageable proportions which eventually become endemic on a global scale.

In the early part of 2008, Arjun Murti of Goldman Sachs predicted crude oil may rise up to $200. He must have found thousands of muppets on whom to dump oil futures and earn hefty bonuses in trading commissions. That is, until February of 2009, when crude only accelerated right back towards the earth to below $40.

By the December of 2014, when the crude had already fallen to $65 from $110 levels Goldman went on to predict a $40 level in the coming months. I am sure they amassed billions in commissions on the basis of their specious advice to gullible investors.

At the time of writing, crude was around $37 and Goldman now says that oil could soon be $20.

"[N]ext time someone tries to sell you a capital-protected market-linked investment/insurance plan... get the hell away, for such a thing doesn't exist now and nor will it in the future."

What amazes me is the blatant manner in which "super" financial institutions such as Goldman Sachs and others across the globe misguide investors and get away with it. No real regulation has been formulated to make these goliaths accountable. No one seems to question them and their perpetual search for muppets continues unabated.

Story 2: A game that everyone played

In a quest to make supernormal profits, many top financial institutions colluded to fix the loan markets at the cost of billions of retail borrowers, rigging the London Interbank Offered Rate (LIBOR) in the process. Former UBS trader Tom Hayes might be the face of the scandal and now a state "guest" for 14 years but can you even begin to imagine that LIBOR, which is allegedly the most transparent measure of global financial health, was fixed fraudulently for decades? As a result loan seekers were paying larger than required interest rates and in every way feeding the bonuses (linked to profitability) of bankers across the globe.

When fraud is at a mass market level, it's in every ones interest to hide it -- for it's impossible to convict 80% of bankers.

Story 3: Collateral damage

It was a sad day on Wall Street when Sarvashreshth Gupta, a 22-year-old Goldman Sachs analyst jumped to his death after complaining of 100-hour work weeks, intense pressure, unrealistic deadlines and ridicule by his boss. When he left India as a student of the University of Pennsylvania, the family probably celebrated the start of a wonderful new future for him (for dreams come true when you travel to new countries for education and jobs and money), not realising that he would end up as a mere pawn to satisfy someone else's greed.

Moral of the three stories

At an extrinsic level these instances might be viewed as isolated cases of individual unscrupulousness/failure/misplaced ambitions. But dig deeper and these stories are a reflection of an irreparable rot that has infested corporate culture. It's a world where irrational demands and insatiable expectations of abnormally high profits make people do things that are outside the bounds of propriety.

Culture in families, in organisations, in countries and on the planet is a function of varying degrees of greed and righteousness. The global culture now sits on a bedrock of an ultra-capitalised greedy planet that is only working towards higher and higher profit and bonuses.

Unless the captains of the industry such as Blankfein and hundreds like him don't take it upon themselves to stem their greed and change the corporate culture, the talent and lives of people like Greg Smith, Tom Hayes and Sarvashreshth Gupta will continue to get wasted. What we need are results, profitability and achievements of Annual Operating Plans that are a function of an organisational culture rooted in happiness, care, trust, patience, compassion -- and not simply a mindless pursuit of month-on-month profit.

We are born to be "naturally" truthful, happy and stress-free and cohabitate peacefully on this planet with each other. Greed and fraud and deceit take a lot of effort. The choice is entirely ours. The seeds we sow in our organisations today are what will eventually form the "corporate culture".

And next time someone tries to sell you a capital-protected market-linked investment/insurance plan (which only God can guarantee) get the hell away, for such a thing doesn't exist now and nor will it in the future.