This year's budget introduced the concept of social security umbrella for all Indian citizens. It was a much-awaited announcement that was sure to make a great impact on millions of Indians who stand at the peripheries of any form of financial inclusion. Soon, three schemes were introduced: Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana and Atal Pension Yojana. All three of them aimed at financial inclusion of every single Indian citizen.

Let's dive into the nuances of PMJJBY and see if it really makes sense for a middle-class person to buy this insurance.

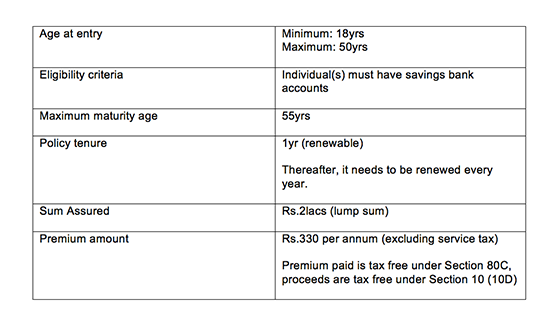

PMJJBY, simply put, is a one-year renewal group term insurance plan that offers a lump sum of Rs 2 lakhs in case of death due to any reason, up to the age of 55 years.

Key Highlights of this scheme:

![2015-09-22-1442902660-6779845-ScreenShot20150922at11.44.28am.png]()

At the onset, let me reiterate that that goal of PMJJBY is to include people who are not covered under any form of insurance and in fact, don't have access to pension support either. In other words, it is primarily targeted towards the poor and unorganized sector. However, there are many people from the middle class who are jumping the bandwagon and buying this insurance on an impulse, perhaps because it is backed by the Government of India.

Well, seeing this from one angle, the PMJJBY scheme sounds too good to be true. Invest Rs.330 a year and you are covered! But, if you look closely, it might not look so glamorous after all, especially for a middle-class person.

Insufficient Sum Assured

If something unfortunate were to happen to the sole bread earner of a middle-class family then Rs 2 lakhs is a meagre amount to fall back on. A middle-class person usually earns somewhere between Rs 40000- Rs.50000 (I am being extremely conservative as I quote this amount). For such a family, Rs 2 lakhs as death compensation would not suffice, considering higher inflation and increasing cost of living.

Age Restrictions

Typically, people falling under the lower income bracket are more vulnerable to serious health problems at an early age and hence, their life expectancy would be comparatively lower vis-à-vis people falling in the middle-class bracket. The latter is more prone to lifestyle-specific diseases. The life expectancy in India is 67yrs and this is expected to increase to 71yrs by 2025 and to 77yrs by 2050. While I commend our government for offering coverage up to the age of 55, I feel it would have been better if the maturity age at least matched the current life expectancy figure (given that there are term plans available in the market that offers coverage up to the age of 80yrs).

Better Deals At Almost Equal Premium

A term insurance plan for a 30yr old non-smoker residing in Delhi and looking to buy Rs.20 lakhs cover for 25 years would cost around Rs.3686 (for Bajaj Allianz - iSecure). Now let's compare this with PMJJBY - assuming it offered a bigger cover of Rs 20 lakhs. If we roughly calculate the premium, it would stand at Rs.3300. Not much of a difference is it? Hence, we can safely conclude that PMJJBY is neither cheap nor expensive.

Can lower premium then be the criteria for buying PMJJBY, given that it comes with certain age restrictions? Instead, I recommend comparing all plans available in the market with PMJJYB before making the final decision.

Situations Where You Can Consider Buying PMJJJYB

Having highlighted the shortcomings of this insurance scheme for the middle class, I don't want to blatantly undermine its value. There are some situations wherein the policy stands good:

• If it is not the only term insurance you are investing in - You can buy PMJJYB in addition to existing insurance as a top-up to strengthen your financial portfolio.

• Buy for a non-earning member of the family - It is a good insurance scheme for a non-earning member of the family like a young brother who hasn't yet started to earn.

• If you intend to buy it in favour of people who work for you i.e. domestic help, milkman, driver etc.

Whatever your decision, make sure you evaluate all possible permutations and combinations, before investing. Do not blindly jump in the bandwagon of government scheme before assessing your current and future family requirements, especially if you happen to be the sole bread earner for your family.

![]() Like Us On Facebook |

Like Us On Facebook |

![]() Follow Us On Twitter |

Follow Us On Twitter |

![]() Contact HuffPost India

Contact HuffPost India

Let's dive into the nuances of PMJJBY and see if it really makes sense for a middle-class person to buy this insurance.

PMJJBY, simply put, is a one-year renewal group term insurance plan that offers a lump sum of Rs 2 lakhs in case of death due to any reason, up to the age of 55 years.

Key Highlights of this scheme:

At the onset, let me reiterate that that goal of PMJJBY is to include people who are not covered under any form of insurance and in fact, don't have access to pension support either. In other words, it is primarily targeted towards the poor and unorganized sector. However, there are many people from the middle class who are jumping the bandwagon and buying this insurance on an impulse, perhaps because it is backed by the Government of India.

Well, seeing this from one angle, the PMJJBY scheme sounds too good to be true. Invest Rs.330 a year and you are covered! But, if you look closely, it might not look so glamorous after all, especially for a middle-class person.

Insufficient Sum Assured

If something unfortunate were to happen to the sole bread earner of a middle-class family then Rs 2 lakhs is a meagre amount to fall back on. A middle-class person usually earns somewhere between Rs 40000- Rs.50000 (I am being extremely conservative as I quote this amount). For such a family, Rs 2 lakhs as death compensation would not suffice, considering higher inflation and increasing cost of living.

Age Restrictions

Typically, people falling under the lower income bracket are more vulnerable to serious health problems at an early age and hence, their life expectancy would be comparatively lower vis-à-vis people falling in the middle-class bracket. The latter is more prone to lifestyle-specific diseases. The life expectancy in India is 67yrs and this is expected to increase to 71yrs by 2025 and to 77yrs by 2050. While I commend our government for offering coverage up to the age of 55, I feel it would have been better if the maturity age at least matched the current life expectancy figure (given that there are term plans available in the market that offers coverage up to the age of 80yrs).

Better Deals At Almost Equal Premium

A term insurance plan for a 30yr old non-smoker residing in Delhi and looking to buy Rs.20 lakhs cover for 25 years would cost around Rs.3686 (for Bajaj Allianz - iSecure). Now let's compare this with PMJJBY - assuming it offered a bigger cover of Rs 20 lakhs. If we roughly calculate the premium, it would stand at Rs.3300. Not much of a difference is it? Hence, we can safely conclude that PMJJBY is neither cheap nor expensive.

Can lower premium then be the criteria for buying PMJJBY, given that it comes with certain age restrictions? Instead, I recommend comparing all plans available in the market with PMJJYB before making the final decision.

Situations Where You Can Consider Buying PMJJJYB

Having highlighted the shortcomings of this insurance scheme for the middle class, I don't want to blatantly undermine its value. There are some situations wherein the policy stands good:

• If it is not the only term insurance you are investing in - You can buy PMJJYB in addition to existing insurance as a top-up to strengthen your financial portfolio.

• Buy for a non-earning member of the family - It is a good insurance scheme for a non-earning member of the family like a young brother who hasn't yet started to earn.

• If you intend to buy it in favour of people who work for you i.e. domestic help, milkman, driver etc.

Whatever your decision, make sure you evaluate all possible permutations and combinations, before investing. Do not blindly jump in the bandwagon of government scheme before assessing your current and future family requirements, especially if you happen to be the sole bread earner for your family.

Like Us On Facebook |

Like Us On Facebook |  Follow Us On Twitter |

Follow Us On Twitter |