India needs job creation! This can only be achieved through new businesses, i.e. start-ups and fast-scaling small to medium entities (SMEs).

Image may be NSFW.

Clik here to view.

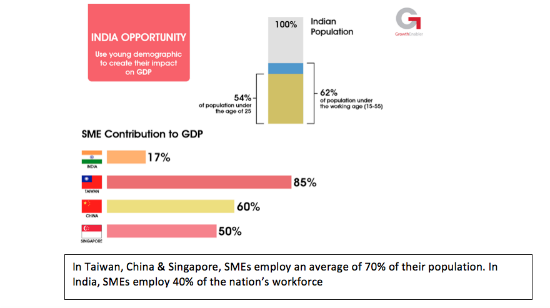

With 62% of India population being of working age (15-55) and more than 54% of its total population below the age of 25, there is a huge opportunity to utilize this younger demographic to ensure there is a positive impact on India's GDP. SMEs employ 40% of the Indian workforce and contribute 17% to India GDP. In contrast, Taiwan, China and Singapore collectively employ about 70% of their populations in SMEs, with a respective GDP share of 85%, 60% and 50%.

In order to address this burning issue, the Budget, needs to address four key factors to accelerate start-ups and SMEs.

1. Access to capital must be democratized

A GrowthEnabler Survey in 2015 found the primary challenge to start-up founders was access to funds and capital. Although, many angels and VCs operating in India provide financial support to start-ups, they are largely limited to metro cities. So, what happens to start-ups and entrepreneurs, with ground-breaking innovation to offer, operating outside of these cities?

If the government provided highly publicised tax benefits for independent investors or private individuals who invest their personal funds into start-up ventures, they would see regulated financing entering the start-up economy. The UK offers a Seed Enterprise Investment Scheme (SEIS) whilst Singapore offers investors an Angel Investors Tax Deduction Scheme (AITD). Both are very successful schemes allowing private investors to claim up to 50% of their investment capital via an income tax refund.

2. Ease of doing business

In a recent YourStory survey conducted with start-ups exploring their expectation of the "Start-up India Stand-up India" launch, their top expectation was to make it easy to start and close your business, bringing us to the second key factor needing review - the ease of doing business.

Although the government is actively seeking to address this concern, there are further recommendations to consider such as simplifying indirect tax on e-commerce and IT service companies, and clarifying tax confusion - for example, "Are we subject to state VAT or service tax or both?" Each department claims their benefit. And, how about the holding period to classify listed equity shares as Long Term Capital Gain? Currently, the holding period is 12 months. Shouldn't a similar provision be extended to unlisted company shares too? This will definitely incentivise investors and benefit startups. Laborious processes such as obtaining a lower deduction of tax certificate from the department need to be simplified. Such a change will surely benefit start-ups.

Let's also look to the future and think of international growth and trade -- when it comes to cross-border transactions, start-ups can be given a different range of transfer pricing Safe Harbour Rules. Why not consider abolishing the Study Route and create a simple TP route with, say, 5% mark-up?

3. Better infrastructure

If India is moving into the digital business world, then businesses will look to the government for better infrastructure. Having lived in Bangalore for the last 18 years I can understand what happens when infrastructure begins to crumble -- travel times to meetings become lengthy, and access to the basics, such as continuous electricity within the industrial belt becomes an issue. This leaves all users, particularly businesses who rely on such infrastructure, deeply frustrated. Lack of quality broadband, and industrial connectivity for supply chain can reduce your productivity and efficiency. The sheer productivity loss can make any industry less competitive, especially when you are competing at a global level.

The Budget must address universal access to wifi for every citizen, benefiting the consumer economy, the knowledge economy and strive to create a Digital India in villages.

According to the Internet and Mobile Association of India, (June 2015), there were a reported 354 million internet users in the country; a vast majority were accessing the web via mobile devices. This means that 70% of India's population has no access to the internet. In addition, according to the Federation of Indian Chambers of Commerce & Industry (FICCI) over 90% of industries use a generator for electricity leading to cost escalation. The Budget needs to provide a subsidy for clean tech energy, particularly solar, simultaneously impacting the Make in India campaign in a big way.

4. Skilling the workforce

Finally, we come to the last, but certainly not least important factor-- access to a skilled and trained workforce. This was identified among the top issues impacting business growth (GrowthEnabler, 2015). The government estimates that India will need an additional 109.73 million skilled workers across 24 key sectors as a part of Make in India. However, it is estimated that only 4.69% of the total workforce in India has undergone formal skills training as compared to 68% in UK, 75% in Germany, 52% in USA, 80% in Japan and 96% in South Korea. This presents a huge challenge. Adding to the problem, is the high number of people entering the workforce every year (estimated to be 26.14 million).

Entrepreneurship based on innovation has immense growth potential. However, the number of local entrepreneurs emerging every year in India is very low. In fact, the Global Innovation Index (2014) ranked India 76 out of 143 countries. Only 0.09 of companies were registered for every 1000 persons of working age, resulting in India having amongst the lowest rates of the G20 countries.

Entrepreneurship, employment rates and a skilled workforce can all be tackled through education and training, i.e., 'skills development institutes' and a big push on 'entrepreneurship education', being introduced at school level. Whilst there are offline operations available for those seeking further development and knowledge, greater reach can be achieved by creating a virtual platform to ensure information is accessible to anyone, anytime, anywhere, overcoming issues of mobility, transport and cost.

Digital India has to be all-inclusive and cater to young first time entrepreneurs, women in entrepreneurship and the entrepreneurs in more remote locations of the country. By acknowledging and addressing the major issues hampering productivity and efficiency, the Budget has the potential to accelerate the success of Indian entrepreneurs.

Indian start-ups are calling, and I hope the government is listening.

Image may be NSFW.

Clik here to view.![]() Like Us On Facebook |

Like Us On Facebook |

Image may be NSFW.

Clik here to view.![]() Follow Us On Twitter |

Follow Us On Twitter |

Image may be NSFW.

Clik here to view.![]() Contact HuffPost India

Contact HuffPost India

Also see on HuffPost:

Image may be NSFW.

Clik here to view.

With 62% of India population being of working age (15-55) and more than 54% of its total population below the age of 25, there is a huge opportunity to utilize this younger demographic to ensure there is a positive impact on India's GDP. SMEs employ 40% of the Indian workforce and contribute 17% to India GDP. In contrast, Taiwan, China and Singapore collectively employ about 70% of their populations in SMEs, with a respective GDP share of 85%, 60% and 50%.

In order to address this burning issue, the Budget, needs to address four key factors to accelerate start-ups and SMEs.

1. Access to capital must be democratized

A GrowthEnabler Survey in 2015 found the primary challenge to start-up founders was access to funds and capital. Although, many angels and VCs operating in India provide financial support to start-ups, they are largely limited to metro cities. So, what happens to start-ups and entrepreneurs, with ground-breaking innovation to offer, operating outside of these cities?

If the government provided highly publicised tax benefits for independent investors... they would see regulated financing entering the start-up economy.

If the government provided highly publicised tax benefits for independent investors or private individuals who invest their personal funds into start-up ventures, they would see regulated financing entering the start-up economy. The UK offers a Seed Enterprise Investment Scheme (SEIS) whilst Singapore offers investors an Angel Investors Tax Deduction Scheme (AITD). Both are very successful schemes allowing private investors to claim up to 50% of their investment capital via an income tax refund.

2. Ease of doing business

In a recent YourStory survey conducted with start-ups exploring their expectation of the "Start-up India Stand-up India" launch, their top expectation was to make it easy to start and close your business, bringing us to the second key factor needing review - the ease of doing business.

Although the government is actively seeking to address this concern, there are further recommendations to consider such as simplifying indirect tax on e-commerce and IT service companies, and clarifying tax confusion - for example, "Are we subject to state VAT or service tax or both?" Each department claims their benefit. And, how about the holding period to classify listed equity shares as Long Term Capital Gain? Currently, the holding period is 12 months. Shouldn't a similar provision be extended to unlisted company shares too? This will definitely incentivise investors and benefit startups. Laborious processes such as obtaining a lower deduction of tax certificate from the department need to be simplified. Such a change will surely benefit start-ups.

The Budget must address universal access to wifi for every citizen, benefiting the consumer economy, the knowledge economy and strive to create a Digital India in villages.

Let's also look to the future and think of international growth and trade -- when it comes to cross-border transactions, start-ups can be given a different range of transfer pricing Safe Harbour Rules. Why not consider abolishing the Study Route and create a simple TP route with, say, 5% mark-up?

3. Better infrastructure

If India is moving into the digital business world, then businesses will look to the government for better infrastructure. Having lived in Bangalore for the last 18 years I can understand what happens when infrastructure begins to crumble -- travel times to meetings become lengthy, and access to the basics, such as continuous electricity within the industrial belt becomes an issue. This leaves all users, particularly businesses who rely on such infrastructure, deeply frustrated. Lack of quality broadband, and industrial connectivity for supply chain can reduce your productivity and efficiency. The sheer productivity loss can make any industry less competitive, especially when you are competing at a global level.

The Budget must address universal access to wifi for every citizen, benefiting the consumer economy, the knowledge economy and strive to create a Digital India in villages.

According to the Internet and Mobile Association of India, (June 2015), there were a reported 354 million internet users in the country; a vast majority were accessing the web via mobile devices. This means that 70% of India's population has no access to the internet. In addition, according to the Federation of Indian Chambers of Commerce & Industry (FICCI) over 90% of industries use a generator for electricity leading to cost escalation. The Budget needs to provide a subsidy for clean tech energy, particularly solar, simultaneously impacting the Make in India campaign in a big way.

4. Skilling the workforce

Finally, we come to the last, but certainly not least important factor-- access to a skilled and trained workforce. This was identified among the top issues impacting business growth (GrowthEnabler, 2015). The government estimates that India will need an additional 109.73 million skilled workers across 24 key sectors as a part of Make in India. However, it is estimated that only 4.69% of the total workforce in India has undergone formal skills training as compared to 68% in UK, 75% in Germany, 52% in USA, 80% in Japan and 96% in South Korea. This presents a huge challenge. Adding to the problem, is the high number of people entering the workforce every year (estimated to be 26.14 million).

It is estimated that only 4.69% of the total workforce in India has undergone formal skills training... This presents a huge challenge.

Entrepreneurship based on innovation has immense growth potential. However, the number of local entrepreneurs emerging every year in India is very low. In fact, the Global Innovation Index (2014) ranked India 76 out of 143 countries. Only 0.09 of companies were registered for every 1000 persons of working age, resulting in India having amongst the lowest rates of the G20 countries.

Entrepreneurship, employment rates and a skilled workforce can all be tackled through education and training, i.e., 'skills development institutes' and a big push on 'entrepreneurship education', being introduced at school level. Whilst there are offline operations available for those seeking further development and knowledge, greater reach can be achieved by creating a virtual platform to ensure information is accessible to anyone, anytime, anywhere, overcoming issues of mobility, transport and cost.

Digital India has to be all-inclusive and cater to young first time entrepreneurs, women in entrepreneurship and the entrepreneurs in more remote locations of the country. By acknowledging and addressing the major issues hampering productivity and efficiency, the Budget has the potential to accelerate the success of Indian entrepreneurs.

Indian start-ups are calling, and I hope the government is listening.

Image may be NSFW.

Clik here to view.

Like Us On Facebook |

Like Us On Facebook | Image may be NSFW.

Clik here to view.

Follow Us On Twitter |

Follow Us On Twitter | Image may be NSFW.

Clik here to view.

Also see on HuffPost: