In a report released last December by the committee on the medium-term path for financial inclusion, the Reserve Bank of India (RBI) broached the concept of "Islamic banking", which refers to the provision of interest-free products to achieve the targets of wider financial inclusion. The report of the RBI committee, headed by Deepak Mohanty, strongly recommends that commercial banks in India be enabled to open specialised interest-free windows, describing them thus:

Islamic banking is emerging globally as a unique banking alternative that believes in a profit-loss sharing module in place of a fixed earned income in form of interest ratio. In addition, it prohibits investment in certain unlawful economic activities and discourages dabbling in speculative markets. Shariah-compliant services are being tested globally in Muslim countries as well as in Western nations in term of better stability and more ethics-oriented financial services. This report advocates the need for Islamic banking with a view to improving financial inclusiveness. Hopefully, this will not be criticised as preferential treatment or economic appeasement.

Indian Muslims largely lag behind other communities in terms of their access to and use of banking services. While some Muslims voluntarily refrain from participating in the conventional banking system due to interest-based transaction, others are involuntarily excluded by scheduled commercial banks which do not show much initiative in developing the banking infrastructure in Muslim-concentrated areas or in providing credit facilities to them. An abundance of non-productive Muslim wealth resources remains idle due to financial exclusion. Such stagnation benefits neither the community nor the country in the long term.

Indian Muslims constitute 14% of the total population, but their share in different financial assets categories (other than shares and debentures) is much lower than their population ratio. Interestingly, Muslims have more assets in micro financing or in the form of ornaments while their ratio in banking, insurance and other conventional forms of assets lag behind.

Banking penetration is also dismal in Muslim concentrated areas. According to data from 2011, the national average for households with a bank account is 68% in urban areas, while it is only 53% in towns where the Muslim population is above 50%. Similarly, Muslims depend more on cooperative societies, friends and relatives for their credit needs. Earlier, the Sachar Committee report also noted the role of non-accessibility of banking infrastructure and absence of credit facilities for Muslims as one of the causes of the community's continuing economic backwardness. The report said:

The introduction of faith-based interest-free services would be a bridging step towards the financial inclusion of Indian Muslims and would fulfil the long term demand of institutionalizing Islamic finance under the direct supervision of the RBI. Hopefully, this will not end up like SBI's aborted Shariah Equity Fund in 2014.

The Government needs to take the RBI committee's recommendation seriously, and at the very least should start a pilot project for Muslim-concentrated centres.

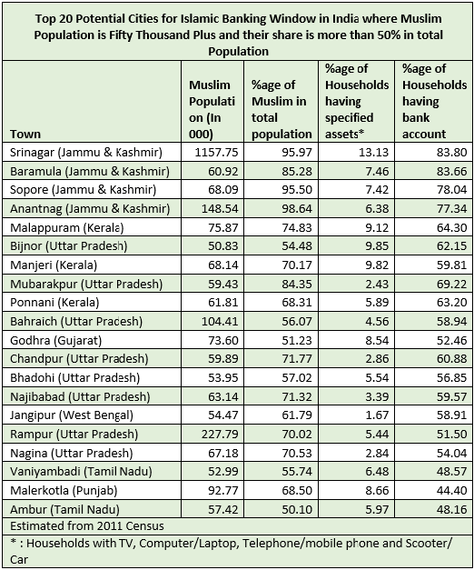

Scheduled commercial banks can be entitled to start Islamic banking windows so that Muslim can experience banking that is in compliance with their faith. A list of 20 high-potential banking centres could be decided on the basis of Muslim population share, banking penetration and financial status where such interest-free banking modules could be initiated as a pilot project. After analysing the results in terms of relevancy and usefulness for the financial inclusion of Indian Muslims in these areas, the Islamic banking module can be replicated in other cities.

![2016-02-10-1455088489-4498212-IslamicBankingWindow_India.jpg]()

An interest-free window is simply a window within a conventional bank through which customers can conduct business utilising only Shariah-compatible instruments. At the inception of the window, the products typically offered are safekeeping deposits --on the liability side of the bank --and relevant trade-finance products for small and medium companies --on the asset side of the bank. It also requires the bank to institute appropriate firewalls to avoid the commingling of interest-free and conventional funds.

Islamic banking is emerging globally as a unique banking alternative that believes in a profit-loss sharing module in place of a fixed earned income in form of interest ratio. In addition, it prohibits investment in certain unlawful economic activities and discourages dabbling in speculative markets. Shariah-compliant services are being tested globally in Muslim countries as well as in Western nations in term of better stability and more ethics-oriented financial services. This report advocates the need for Islamic banking with a view to improving financial inclusiveness. Hopefully, this will not be criticised as preferential treatment or economic appeasement.

An abundance of non-productive Muslim wealth resources remains idle due to financial exclusion. Such stagnation benefits neither the community nor the country in the long term.

Indian Muslims largely lag behind other communities in terms of their access to and use of banking services. While some Muslims voluntarily refrain from participating in the conventional banking system due to interest-based transaction, others are involuntarily excluded by scheduled commercial banks which do not show much initiative in developing the banking infrastructure in Muslim-concentrated areas or in providing credit facilities to them. An abundance of non-productive Muslim wealth resources remains idle due to financial exclusion. Such stagnation benefits neither the community nor the country in the long term.

Indian Muslims constitute 14% of the total population, but their share in different financial assets categories (other than shares and debentures) is much lower than their population ratio. Interestingly, Muslims have more assets in micro financing or in the form of ornaments while their ratio in banking, insurance and other conventional forms of assets lag behind.

Banking penetration is also dismal in Muslim concentrated areas. According to data from 2011, the national average for households with a bank account is 68% in urban areas, while it is only 53% in towns where the Muslim population is above 50%. Similarly, Muslims depend more on cooperative societies, friends and relatives for their credit needs. Earlier, the Sachar Committee report also noted the role of non-accessibility of banking infrastructure and absence of credit facilities for Muslims as one of the causes of the community's continuing economic backwardness. The report said:

Steps should be introduced to specifically direct credit to Muslims, create awareness of various credit schemes through publicity and organise entrepreneurial development programmes, bring transparency in reporting of information about SRCs on provision of banking services.... Economic empowerment and financial security have important linkages, in increasing demand for education as well as providing the means for doing so. This will initiate an upward push that has the potential to bring about improvements in socio-economic status of the Muslim community.

The introduction of faith-based interest-free services would be a bridging step towards the financial inclusion of Indian Muslims and would fulfil the long term demand of institutionalizing Islamic finance under the direct supervision of the RBI. Hopefully, this will not end up like SBI's aborted Shariah Equity Fund in 2014.

The Government needs to take the RBI committee's recommendation seriously, and at the very least should start a pilot project for Muslim-concentrated centres.

The Government needs to take the RBI committee's recommendation seriously, and at the very least should start a pilot project for Muslim-concentrated centres.

Scheduled commercial banks can be entitled to start Islamic banking windows so that Muslim can experience banking that is in compliance with their faith. A list of 20 high-potential banking centres could be decided on the basis of Muslim population share, banking penetration and financial status where such interest-free banking modules could be initiated as a pilot project. After analysing the results in terms of relevancy and usefulness for the financial inclusion of Indian Muslims in these areas, the Islamic banking module can be replicated in other cities.